Local governments are tasked with more than ever these days—often with tighter budgets and fewer employees. That’s why it's critical to keep up with growing market segments and secure additional revenues incrementally. Like the booming short-term rental industry. Whether your community has just a few listings today—or a few thousand—you need to take a long-term view at how to monitor short-term rentals in your community and collect taxes and fees from hosts.

What exactly is a short-term rental? Local ordinances may have specific definitions particular to that area; however, short-term rentals are generally defined as furnished units that are available for short periods of time, from just a day to a month.

However, short-term rentals take many forms across the world, such as a spare bedroom in an owner-occupied home, an entire apartment or home, or alternate accommodations such as yurts, treehouses, Airstream trailers, tiny homes, and more.

In addition to “short-term rental,” these accommodations go by many terms—and so do applicable taxes. Also knows as transient rentals, vacation rentals, and, most recently, condotels, short-term rental properties generate taxes and fees known as transient occupancy tax (TOT), transient tax, short-term rental tax, or fall under standard hotel-motel tax. Read about these short-term rental ordinances in the news.

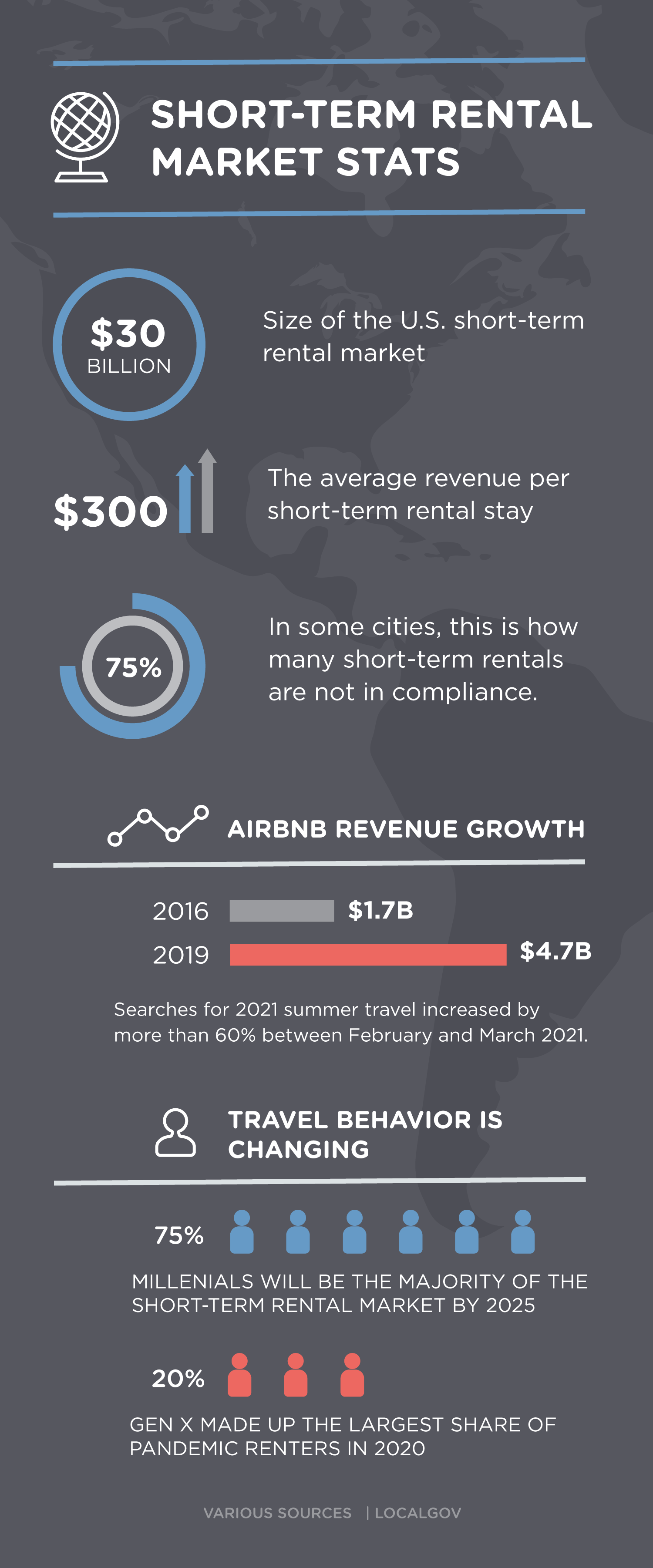

There are tens of thousands of individual companies and dozens of short-term rental platforms across the country, some big and some small, operating in big cities, small towns—and every community in between. This is a $30 billion dollar market, predicted to rebound big in 2021 and 2022.

Airbnb recently polled more than 1,000 Americans as to their 2021 travel plans, especially now that vaccines are becoming more and more available. According to this winter/spring 2021 report, Americans will likely be hitting the road this year with more confidence than last year, but still abundant caution. Read our five key takeaways from this new survey.

Local governments needs to understand the scope of the national vacation rental market so they can be proactive in their compliance approach. Here are some key statistics:

If you don’t understand the short-term rental market, you can’t manage or monetize. Let’s dive deeper and take a look at obstacles local governments face when it comes to monitoring a community's short-term rental industry.

According to a recent report released by Airbnb, the company is starting to see some distinct changes in how Americans are vacationing that it predicts will extend will into 2021. Read about what your community should do to prepare for a boost in short-term rentals and download the guide.

A recent shift in short-term rental trends is creating opportunities for smaller municipalities to market themselves and —as well as the need to manage increased demands from short-term rental hosts and guests. Check out these tips for how municipalities should prepare and react.

Read on to see what revenue reviews—or compliance audits—can do for your city’s finances and your business community.

Localgov's parent company, Azavar, has more than 25 years of experience with comprehensive compliance audits for municipalities. Learn how Azavar's revenue discovery system has brought home more than $500 million to 400+ communities across the United States.

Hudson, New York is a favorite destination of New York City residents. As a result, the short-term rental market has boomed. But keeping up with the listings, and making sure all hosts were following local laws? That was a major challenge for city leaders. A compliance audit uncovered dozens of properties out of compliance, to the tune of $30K each year, and connected its management with actionable data.

>> Read the full case study here.

Once we started looking, we realized that we probably had many more short-term rental properties than we knew about.”

—Brenda Hurst, Chief Fiscal Officer, Erie County, Ohio

More than ever, it’s important for local governments of all sizes to proactively manage its transient rental market. Whether or not your community experiences a boom in travel, this sector requires oversight, management, and monetization.

But many governments lack in-house resources to develop and refine ordinances, monitor listings and remittances, and provide the kind of online registration and payment tools to ensure quick payment by hosts. Take a look at these communities growing their TOT revenue and learn how they took control over their vacation-rental market.

What does tax compliance really mean? Simply put: it's making sure laws are followed and applicable taxes and fees are paid. Sounds easy, but city finance directors know that achieving 100% host compliance is the goal—and a challenge.

After adding an ordinance, it's important to conduct regular compliance audits aka revenue reviews. Then, a community is well-positioned to realize 100% tax compliance—on short-term rental taxes or any other tax. This method is universally applicable to any remittances paid to a local government.

Here’s how municipalities should work toward total tax compliance for all taxpayers, from single-unit hosts to larger hospitality groups and even short-term rental platforms.

Host compliance happens when taxpayers comply with your laws. Sounds simple. But it takes a closed loop of clear laws, revenue reviews, and smart administration to reach 100%.

Part of our approach to revenue management for local governments includes our comprehensive tax-and-fee collection and accountability solution that helps hosts register rentals, pay taxes, and get in compliance quickly.

Learn about our short-term rental tax-administration solution.

Localgov is a great way for governments to provide a user-friendly technology solution that saves taxpayers time and effort—while also helping ensure total tax compliance.

Interested? Learn more about Localgov and set up a demo.

I can't tell you how much I appreciate a call from a 'live person.' I look forward to filing my monthly taxes online.”

— Claudius Edmond Huggins Jr., Short-term rental host, Sunset Beach, NC

Get started with our revenue discovery system for municipalities.

We are excited to learn about your community's short-term rental market and your tax-compliance challenges. Let's talk—at your convenience—about how our team can help you nurture this growing market segment and secure additional revenue for your local government. Schedule your Localgov short-term rental administration demo today.

Copyright © 2024 Localgov. All Rights Reserved.