Located on the eastern bank of the Mississippi River, Quincy is Illinois’ “Gem City.” For nearly 200 years, this remarkable community has served as a major crossroads of the midwest due to its central location along the river. While Quincy’s past is alive through its well-maintained historical districts and amenities, its future is bright. A bustling hospitality trade serves as one of the town’s main economic drivers, as Quincy is home to a delightful array of eateries, breweries, and wineries.

Recognizing its growing popularity as a must-stop spot along the mighty Mississippi, Quincy’s leaders wanted to ensure that their community continued to prosper and shine bright as the jewel of the region for years to come.

Dr. Linda Moore, Quincy’s much-beloved treasurer, wants the City to work as hard for its residents as possible, which requires a steady stream of funds to support key activities. Her goal is to achieve predictable revenue flow that is equitable for the business community, yet she knew there were significant revenue leaks particularly in the hospitality sector.

New business models had moved into the city, such as short-term vacation rentals from providers such as Airbnb, HomeAway, Vrbo, and dozens of other rental platforms. Like many municipalities, Quincy lacked a system and the time to conduct comprehensive revenue audits. Without that, they couldn’t discover how much money Quincy was losing through unpaid taxes, identify which hosts failed to remit, or even understand how many vacation rentals existed within its borders. In addition to short-term rentals, Moore needed help implementing a new food and beverage tax that required educating taxpayers as well as registering and collecting from over 380 establishments. The situation was decidedly daunting for Moore and her team.

“We knew we needed a company with experience and convenient, cost-effective solutions,” said Moore. Her team vetted an array of revenue-review providers but really wanted a true partner.

With more than 25 years of dedicated service to municipalities, Azavar brought the local-government bona fides that Quincy wanted, plus the bottom-line results its budget needed. “I knew what Azavar had done for other cities, and the company was willing to be our partner in recovering lost revenue streams and identifying new opportunities,” reflects Moore. So Azavar got to work.

The revenue-review team from Azavar helped Quincy understand where it was losing out and how to tackle slippage. In fact, within a few months, Azavar worked with Quincy to eliminate ambiguities in its short-term rental ordinance that were really adding up. In addition to the $70,000 recovered through our cable revenue review, our team recovered nearly $21,000 in missing hotel-motel and short-term rental taxes due to Quincy—a boost of 2% in hospitality tax revenues.

But more than just collecting on taxes in arrears, Moore wanted to offer Quincy businesses a more convenient, cost-effective way to remit taxes that worked for them—and the City.

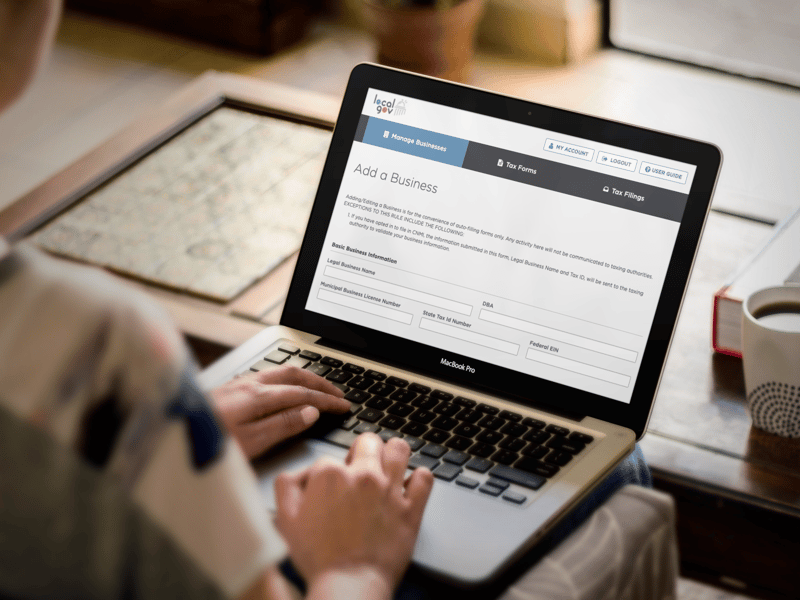

Localgov, is a cloud-based remittance platform that helps administer taxes and fees. Localgov offers a secure, consumer-style filing and payment solution that allows them to manage accounts, pay via credit, debit, or ACH, and avoid waiting in line or paying late fees. Learn more about Localgov's short-term rental tax compliance solution here.

It’s been popular with Quincy’s taxpayers and taxpayer agents. “For accountants who might submit taxes for dozens of local businesses, says Moore. “They’re reporting significant time savings. They’re thankful it’s so easy.” This ease of use means that compliance has gone through the roof.

Within just 60 days, more than 94% of Quincy’s business taxpayers had registered and paid food-and-beverage taxes, and Moore’s team expected to achieve total compliance by their goal date.

Quincy achieved complete hotel-tax compliance almost immediately. Localgov’s Concierge Customer Service team made it happen through direct outreach to business taxpayers, carefully explaining how to use Localgov and answering any questions. Combined with Localgov’s easy-to-use interface, this service took the heavy lifting off Quincy’s municipal staff.

As a historic city, Quincy is fond of looking to its past. And with Azavar’s analytical acumen, taking a moment to examine historical trends and gaps paid off handsomely with a deep-dive revenue review. But Moore and her team also have an eye on tomorrow. Her team needed a future-looking partner with capabilities that enhance the City’s bottom line and enhance the business experience, too.

It’s this one-two punch that Azavar, combined with Localgov, offered Moore’s finance team. Together, Azavar and Localgov provided the “experience, knowledge, and commitment to service that made it possible for us to find new revenue that we could not have found on our own,” says Moore.

We thank Quincy for the opportunity.

Our team would love to talk with your local government about how Localgov can bring convenience and compliance to your community. It’s easy to get started. Schedule a personalized demo at your leisure.

Book a demo with our team today.

Quincy taxpayers and accountants appreciate that they can pay via ACH draft, credit, or debit, all from their home or office, and get instant confirmation they’re compliant.

Quincy achieved almost total taxpayer compliance on new food-and-beverage taxes because of Localgov’s easy design and our Concierge Customer Service team.

When your staff are freed from opening envelopes and processing manual paper payments, you can devote more employee time to higher-value tasks or programs.

"Combining both the tax audit process and the tax collection process on the back end with one company really made for a package deal that made sense for us economically and logistically. I don’t know that I have had any other vendor, client, software company, or partner in my 40 years of professional experience that has been so exceptional at their job."

Linda Moore

Treasurer, the City of Quincy, Illinois

Copyright © 2024 Localgov. All Rights Reserved.